Blockchain startup DFINITY raised CHF102 million in venture funding to bring its total funding to $190 million. And it hasn’t even launched yet. But in the bubbly blockchain funding space, CHF 102 million isn’t especially attention-grabbing. But it can be a signal.

One of the most notable points is a Forbes quote from Ethereum co-founder and Consensys CEO Joe Lubin: “Among the candidates to move into the Ethereum space, the strongest one is probably Dfinity”.

There’s a crowded field of Ethereum contenders. And a tremendous amount of hype. There’s a little less noise from DFINITY in that you don’t see a press release every five minutes. But they’re no shrinking violet. DFINITY says it’s developing the “Internet Computer”. And Dominic Williams, DFINITY’s President, states: “our aim is to build out what we term a ‘NASA for decentralization’ to stand behind the network.”

If NASA refers to the quality of the team, it isn’t entirely hyperbole. Talented scientists and developers gravitate to work with high caliber teams. DFINITY investors and a16z partners Chris Dixon and Ali Yaya wrote: “The group of people that Dominic has assembled over the past several years is, far and away, one of the most impressive teams that we have met in the space.”

What problem are they targeting? Scalability + other blockchain challenges

Does it solve it or is it likely to? Looking good so far

When did they start? 2015

Whats the quality of the team? On the tech side: exceptional

Who are the backers? Polychain Capital, Andreessen Horowitz +

What’s the signal-to-noise ratio? Reasonable

The Technology

The explanations provided by DFINITY’s Mahnush Movahedi in this video are brilliant. If you’d like to understand a little more about the technology and challenges involved in most blockchains, this is well worth your time.

Some of the solutions that DFINITY incorporates are very distinctive.

Tech features

DFINITY claims to have superior speed and scalability, without sacrificing security. Both Bitcoin and Ethereum sacrifice speed and scalability in order to be secure. At the core is DFINITY’s decentralized randomness innovation.

The importance of randomness

Decentralization involves copying or replicating data from one machine to another. That often requires having a leader that’s says what to copy, because it’s quicker and more efficient to poll a leader than everyone talking to everyone else. There are many ways to decide a leader, but if it’s predictable, then the leader could be hacked, which renders the network insecure.

Bitcoin’s way of appointing a leader is particularly secure. However, Bitcoin’s method is slow, power hungry, and not very scalable. DFINITY’s solution is to create a random leader. That’s super hard to do in a secure decentralized way.

However, should another tech team find fault with DFINITY’s randomness methodology, it could undermine a significant part of the technology.

Finality is a critical aspect for any business application. Finality refers to the likelihood or lack thereof that the transaction will be reversed. The servers on the network have to talk to each other to ensure a transaction isn’t a fraud. Hence, in a decentralized network, for a short time, there’s a possibility that a transaction could be reversed.

Using Bitcoin is very different from using a card in a store. It’s reasonable for you to assume the card payment is a done deal. Not so with Bitcoin. At a minimum, you have to wait ten minutes to know whether a Bitcoin transaction even happened (Ethereum: 15 seconds).

But the transaction is only considered final after sixty minutes (Ethereum: 6 minutes). Even then there’s a small possibility that it could be reversed. DFINITY claims to be able to achieve finality in 5-10 seconds compared to Ethereum’s six minutes.

Significant blockchain code upgrades are currently very painful and hence happen infrequently. They also risk splits or forks among the community. Hence the existence of Bitcoin and Bitcoin Cash. DFINITY says the protocol’s code will regularly update without these hassles.

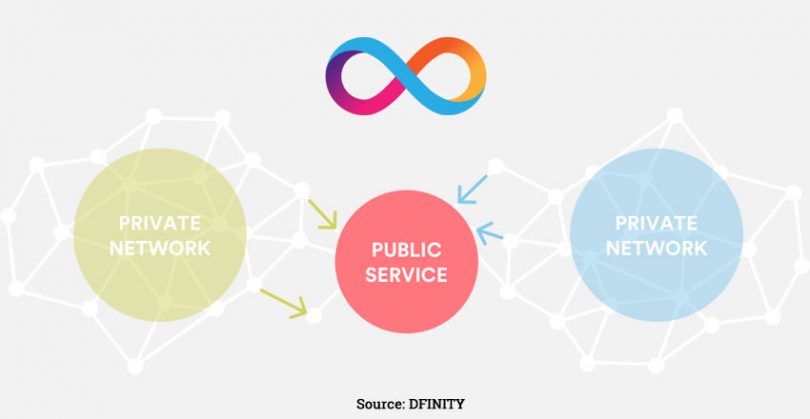

From an enterprise perspective, one of the most relevant aspects is the interoperability DFINITY promises between public and private networks. A system call on a private network can trigger a twinned event on the public network. It’s designed so if the public code execution fails to happen, the private call will be unwound.

Other networks, notably Cosmos and Polkadot also address interoperability issues. Cosmos is close to launching. The Agreements Network plans to use Cosmos to link their permissioned network with Ethereum to execute payments.

Conclusion

The latest funding was a ‘pre-sale’ round. In April Williams said it was too risky to run an ICO, hence they’ve limited themselves to accredited investors. However, in June they ran a CHF 35 million airdrop for community members. That means roughly 46% of DFINITY’s tokens are in circulation with the remainder still held by the foundation.

DFINITY plans to launch the network in late 2018 or early 2019.

The author owns less than $500 of Ether tokens and no others.